To stay competitive in the building materials and home improvement industry, you have to keep an eye on market demand, along with emerging opportunities for growth and the sales potential of new or enhanced products.

This involves identifying and responding to the trends that contribute to increased or decreased demand for various types of building products, or specific features therein. Market sizing research will also help your company forecast and strategize in a thoughtful and responsive way so you are investing in the right opportunities that present the greatest potential for customer acquisition, market share, and profit.

How Do You Identify Growth Markets?

In the construction materials and home improvement industry, markets present opportunities for manufacturers and suppliers when they are growing or expanding at an increasing rate. These are known as growth markets. For example, eco-friendly and sustainable building opportunities, smart home automation, and wearable technologies in construction represent growth markets.

Sometimes the growth is organic, being driven by population increase, growing urbanization, infrastructure investments, economic and regulatory changes, or other current events. Other times, the demand for a particular product is driven by the evolution of customer preferences, new customer acquisition, the disruptive introduction of new technologies, and other shifts within the industry.

Growth markets can present your company with a good opportunity for increased profits, but you have to stay ahead of the curve. To that end, forecasting across various customer and channel segments within the industry is crucial. It’s also very challenging.

Generating a general consensus from building professionals via a survey can be helpful, but the data is often colored by optimism. It’s more valuable to take an analytical approach to this process by measuring market demand, determining frequency of product purchases, and calculating brand shares by channel segments. These insights allow you to effectively strategize for future scenarios within the market.

How to Determine Market Demand for Products

Residential new construction and home improvement market growth is influenced by numerous demand factors. A few of these include:

- The total number of people in the market

- Current utilization of products and/or purchase incidence

- The tastes, attitudes and preferences of customers

- The success of advertising and marketing campaigns and a company’s overall brand awareness in various product categories

- The frequency of product use and quantities purchased

- Prices paid or price shifts for related goods (particularly items that complement or could substitute your products)

- Expectations about future demand for a product or material

On the flip side, an industry shows signs of decline when it’s not able to keep up with the rest of the country's economic growth. This can happen when a raw material used for a building product becomes scarce or obsolete, when new technologies or products emerge to replace old ones, or when demand shifts dramatically. Think of how the concrete sector faces this challenge, for example.

Market Size Forecast Factors Often Differ from Product and Category Share Factors

Keep in mind that the demand factors influencing forecasts of total market size are often different from the factors used to determine the market share of a particular product or a product-category share. For example, the total demand for exterior paint depends in part on factors like the number of property owners in a market, their needs and habits, the local climate, and how the climate affects the average lifespan of paint on outdoor structures. However, the demand for a particular type or color of paint from a specific brand is influenced by the price and quality of that paint compared to similar products on the market and exterior design trends.

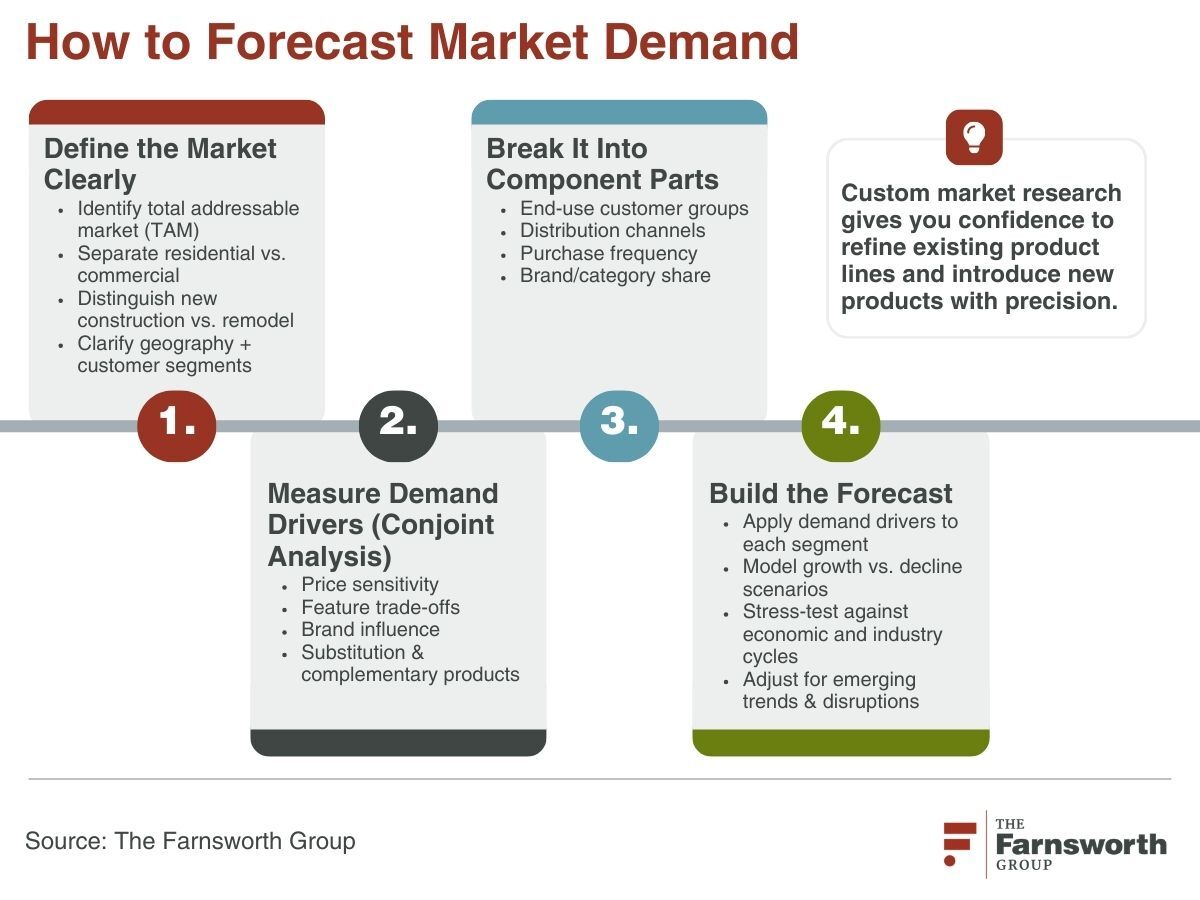

When you are forecasting demand, it’s important to first define your market and then break it down into its component parts. These segments—which could be based on end-use customer groups or distribution channels—should be narrow and focused enough that the factors driving demand can be applied consistently during your market sizing research.

Then, using conjoint analysis to assess demand drivers and create a demand forecast, you and your teams can adjust existing product lines and introduce new products in a wise way.

What Trends Impact Demand in the Residential Market?

Knowing when to expect a change in the construction market—especially your particular segment—is valuable. It enables you to plan ahead to operate differently in decline markets versus growth markets and identify new opportunities for acquisition, distribution or revenue.

While the construction market in general tends to be cyclical, contracting every 10 to 15 years or so, there are other nuances to pay attention to.

Historical demand for a product isn’t always a reliable variable for forecasting future demand since the relationships influencing demand change over time. Current events, the advent of new technology, and other factors can impact specific segments of the construction market or the demand for particular products. In an industry facing massive disruptions to product offerings and distribution channels alike, historical trends may or may not hold true in the present.

Take the global response to COVID-19, for example. This impacted nearly every aspect of life, including the purchasing behaviors of DIYers and construction professionals and other customers in this market. Even now, years later, in the HVAC market, systems and products that improve indoor air quality (IAQ) and mitigate airborne contaminants are still trending. While healthy home trends have stabilized a bit from the peak they reached between 2020 and 2022, they are still elevated compared to pre-pandemic trend, with nearly a third of homeowners citing health and safety concerns related to their living environment, according to findings in our Healthy & Safe Home and Environmental & Energy Performance Attitudes report, developed in conjunction with the Harvard Joint Center for Housing Studies. And managing pollutants and dust remains a top concern, along with other IAQ-related issues.

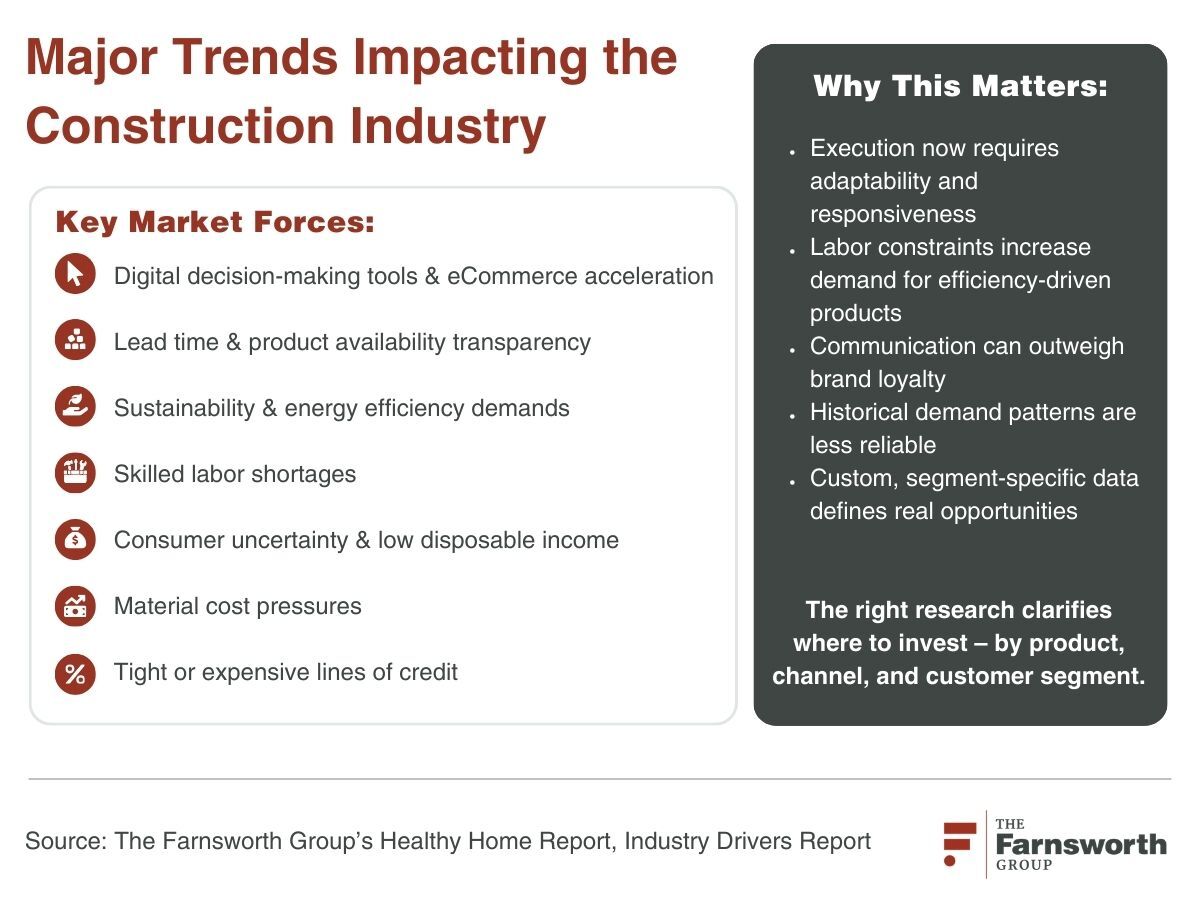

More importantly, there has been a shift in how customers are purchasing, or the distribution channels they rely on. During the pandemic years, eCommerce purchases became more prevalent and digital decision-making content, like visualizers, more sought after. The trends were already there, but they were accelerated.

Lead time and the availability of products and materials are also influencing purchase decisions more than brand loyalty. Research shows that, in general, the companies who can communicate better with customers regarding those factors before, during and after the sale fared the best overall.

Some other major trends currently influencing the construction outlook include an increased focus on sustainability; challenges securing adequate labor; consumer uncertainty and low disposable income; material cost pressures for contractors; and challenges securing affordable lines of credit. These constraints create a market defined by volatility rather than weakness, where opportunity exists, but execution requires greater adaptability and responsiveness across the supply chain, so it’s important to be aware of them and adapt your strategies accordingly.

Additionally, when labor is tight, options that require less labor to install, even if slightly higher in price, can prove more desirable to general contractors. Ready-frame options, for example, help mitigate some of the labor shortage headaches GCs are facing.

Using Market Research for your Construction Outlook

Paying attention to secondary research that calculates the timing of market cycles and watching for trends in the construction industry enables your company to stay nimble and successful. Commissioning your own primary research for your product category and brand specifically is even more informative. This type of data will help you define the opportunities and goals for your product, distribution and customer segment.

To assist with custom market sizing research, our team at The Farnsworth Group collects data about population sizes, the frequency of product purchases and other factors to provide you with addressable market and sales potential by customer segment and channel segment. We then apply more than 350 years of combined industry knowledge to bring a deeper level of analysis and recommendations. You end up with data-driven insights supported by industry expertise that provide you with actionable recommendations.

Learn more about the approach our team used to help a finished plumbing manufacturer understand the U.S. size of market for shower drains.